This page details all the import fields for when you import your sales order records from a file. The steps to import your sales orders are covered on another page.

This page should help you format the data in a way that we are expecting so that we can successfully upload your data.

Very few of the fields are mandatory. When importing, you do not have to hook up every import field or include data for every field. Generally blank data is either defaulted or ignored.

You can download a blank import template file to use to import your sales orders. Once you have downloaded this file, feel free to rename it with any name, but you must save it as a csv type file, not an xls or xlsx type file.

You can also download an example file with example data. Do not use this file to import with.

An example of how to format your pricing values is available.

You can also view a quick heads up on the data types. This is useful for evaluating any import errors.

Identifier fields

- Order Reference

- Is a mandatory field. 40 characters max. This field will be used as the Customer Reference.

Order detail fields

- Order Grand Total

- The total amount of the sales order. If there are multiple product lines, then just repeat this amount for each product line.

- Customer First Name

- If this is a business, then insert the entire company name as the first name. Otherwise, insert the persons first name.

- Customer Last Name

- This should be a surname if the order is for a person, but not a business name. The field can be left blank if the order is for a business.

- Customer Email

- The email address of the customer.

- Billing Address Line 1

- Generally this is the number and street of the billing address. Otherwise, the Box number or private bag etc.

- Billing Address Line 2

- An additional line for detailing the billing address.

- Billing Address Line 3

- An additional line for detailing the billing address.

- Billing Address Town

- The town or city.

- Billing Address Post Code

- The post code or ZIP.

- Billing Address Region

- The region, province or state.

- Billing Address Country

- The country.

- Shipping Address Same As Billing

- If the billing and shipping addresses are the same, then simply insert either Y, Yes, True or 1.

- Shipping Address Line 1

- This is the number and street of the shipping address. For courier deliveries this should not be a PO Box or private bag.

- Shipping Address Line 2

- An additional line for detailing the shipping address.

- Shipping Address Line 3

- An additional line for detailing the shipping address.

- Shipping Address Town

- The town or city.

- Shipping Address Post Code

- The post code or ZIP.

- Shipping Address Region

- The region, province or state.

- Shipping Address Country

- The country.

- Shipping Method

- This should be explicitly one of the following:

-

- Courier

- Post

- Collection

- Free Shipping

- Own Transport

- Freight

- Requested Shipping Date

- This is likely to be the same as the created date, unless the goods are to be shipped at a future date. We prefer the format YYYY-MM-DD, but will also accept DD/MM/YYYY. Eg, 2012-11-29 or 29/11/2012

- Order Shipping Amount

- The total cost of shipping for the order.

- Order Shipping Description

- This could be a description of the shipping method, shipping type or code.

- Order Shipping Tax Percent

- The percentage of tax applied to the shipping for the total order. This is not the tax applied to each product line.

- Order Shipping Tax Amount

- The amount of tax applied to the shipping for the total order. This is not the tax applied to each product line.

- Payment Method

- This should be explicitly one of the following:

-

- Bank Transfer

- Cash

- Credit Card

- Cheque

- EFTPOS

- Escrow

- PayPal

- Other

- Is Payment Received

- Denotes whether the sales order has been fully paid.

- Payment Reference

- This field is generally only used in conjunction with a Payment Method of Other. For Trade Me sales this will be the listing number. For Shopify sales this will be the Shopify order number.

- Is Manually Approved

- Defines whether the sales order or any of the products on the sales order require manual approval.

- Payment Terms

- This should be explicitly one of the following:

-

- Immediate

- Cash

- 7 days

- 14 days

- 21 days

- 28 days

- 30 days

- 60 days

- 90 days

- 20th of month following invoice

- Public Notes

- These are the notes that are visible to the customer/buyer on the packing slip and invoice etc. A maximum of 4000 characters is permitted.

- Private Notes

- These are the notes that are never visible to the customer/buyer. A maximum of 4000 characters is permitted.

- Is Tax Applicable

- This defines if taxes are applied to the sales order.

- Order Discount Amount

- This is the discount amount to apply to the sales order. It is not percentage based.

- Prices Tax Inclusive

- Defines whether the taxes on the product line items are to be displayed with or without tax.

- Label List

- Optional. The names of any labels to apply to the sales order. Separate multiple labels with comma's. Labels which include a comma should be enclosed in double quotes.

- Eg, Novelty Item, "Asia, Europe", Fragile

Order line fields

- Product Code

- This is a product code which must already exist in your Tradevine organisation. Each product code cannot be duplicated for each sales order.

- Quantity

- The quantity for each product on the sales order.

- Unit Price

- This is the Sell Price for each product. It is the total price of the product multiplied by the quantity. If Prices Tax Inclusive was set to Yes, then ensure the Unit Price is tax inclusive. Otherwise, it should be tax exclusive.

- Tax Code

- For each product this is the tax code to apply to each product. We are typically looking for an explicit match on: GST, None, Exempt or Zero. A couple of the rarer ones are: VAT or REDUCED.

- Tax Percent

- The tax percentage to apply to the product. This can sometimes be zero.

- Tax Line Amount

- The amount of tax applied to the product.

- Line Note

- These are the product notes, which are only displayed on the sales order's packing slip and invoice etc.

Pricing Example

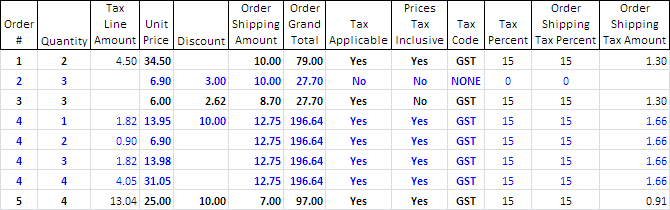

Your sales orders will only import if all the pricing values balance. One column to pay attention to is Prices Tax Inclusive. This determines whether your prices to import, do or don't include tax. In the example below there are 5 sales orders to import with various combinations of tax, line items, discounts and shipping.

If you have tax applied and your prices are tax inclusive, then your values should be tax inclusive and the calculation will be something like (Quantity x Unit Price) – Discount + Order Shipping Amount.

If your prices are tax exclusive, then your values should be tax exclusive and the calculation will be something like ((Quantity x Unit Price) + Tax Percent) – (Discount + Tax Percent) + (Order Shipping Amount + Order Shipping Tax Percent).

Data formats

- Boolean

- Never heard the term before, you pass the "I'm not a geek" test. These are essentially true or false values. Eg, TRUE, Yes, Y, 1 or FALSE, No, N, 0

- Decimal

- These are basically monetary values or decimal values represented as just numbers and an optional period character. Eg, 10 or 10.1234. If the field is a monetary type field, we can sometimes also handle the currency character. Eg, $10.12

- Integer

- These are numbers within the range -2,147,483,648 to 2,147,483,647. We tend to be interested in the positive numbers within this range.

- Short Integer

- These are numbers within the range -32,768 to 32,767. We tend to be interested in the positive numbers within this range.